24+ Cash out refinance rates

The current average mortgage rate for a 30-year fixed-rate loan is 566 according to Freddie Mac. If your mortgage rate is above 666 now is probably a good time to refinance.

2

Your level of equity matters.

. For example if you had a 50000 mortgage and your home is worth 100000 you could refinance for 80000 and pocket the. Switching to a fixed-rate loan. 45 5 Read full card review Chase Freedom Unlimited.

If you qualify for a cash-out refinance loan you might get a new loan for. It is probably worth considering a mortgage refinance if you can reduce your current interest rate by at least 05. If youre thinking of doing a cash-out refinance or refinancing your home mortgage to.

Learn about the VA cash-out refinance loan see todays VA cash-out rates and understand the requirements to turn your homes equity into cash or refinance a non-VA loan. If you have an adjustable-rate mortgage switching to a fixed-rate loan could be a good move. Bankrates View 24 to 72 months.

Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie. Check out the mortgage refinancing rates for August 24 2022 which are largely down from yesterday. Rates last updated on August 24 2022.

A cash-out refi looks like a normal auto loan but you borrow money in addition to the loan balance. 247 customer service. She edits articles about mortgage rates refinance rates lenders bank.

Say your Honda Civic hatchback is worth 15000 and the loan balance is 9000. Cash-out refinance requirements 2022. You can see prequalified.

2 min read Jun. Bankrate reviewed and compared the best auto loan refinance rates. APR From 799 Loan Amount.

How mortgage rates have changed over time. Guide to cash-out refinancing. Many homeowners use a cash-out refinance to pay for home improvements.

Compared to high-interest credit cards it may be more affordable to access the cash you need with a cash-out refinance. Credibles free online tool will let you compare rates from multiple mortgage lenders. Min Credit Not.

The following cash-out rates are current as of Sep 7th 0607 PM CST. A cash-out refinance is used to turn your home equity into cash. CFG offers a competitive interest rates on its money market account.

Check out the mortgage refinancing rates for August 24 2022 which are largely down from yesterday. Expect your rate to be about 0125-025 percent higher than the standard refi rates youd qualify for. You also dont have to refinance into a 30.

Does cash-out refinancing have higher interest rates. 1624 - 2624 Variable APR will apply. Plus if current interest rates are lower than your.

30-year refinance rates. If youre thinking of doing a cash-out refinance or refinancing your home mortgage to. BushIt became law as part of Public Law 110-343 on October 3 2008 in the midst of the financial crisis of 20072008It created the.

If you need cash have enough equity and interest rates are favorable a cash-out refinance might be the right solution. Representatives Available 247 to Better. If youre thinking of doing a cash-out refinance or refinancing your home mortgage to lower your interest rate consider using Credible.

A 3 fee min 10 applies to all balance transfers. Representatives Available 247 to Better Serve Troops Overseas 1-800-884. Cash-out refinance rates.

How to do a cash-out auto refinance. A Cash-Out refinance is an option for those with a VA or conventional loan looking to take advantage of. That means you have 6000 in equity.

The Emergency Economic Stabilization Act of 2008 often called the bank bailout of 2008 was proposed by Treasury Secretary Henry Paulson passed by the 110th United States Congress and signed into law by President George W. Why it stands out. How to refinance your mortgage.

These rates are based on the assumptions shown here. WHAT IS CASH-OUT REFINANCING AND HOW DOES IT WORK. Take advantage of historically low mortgage and refinance rates from our national marketplace of lenders.

The VA Home Loan program provides qualified homeowners with a simple way to take advantage of lower rates and decrease their monthly mortgage payment. VA Loan Type Interest Rate APR. Discover it Cash Back.

Crunch the numbers in our refinance calculator. VGLI Monthly Premium Rates Effective July 1 2014. Compare current cash-out refinance rates learn more.

Amount of Insurance Age 29 Below Age 30-34 Age 35-39 Age 40-44 Age 45-49 Age 50-54 Age 55-59 Age 60-64. For example if you only owe 5000 on your car loan but your vehicle is worth 10000 you have 5000 worth of equity. If you refinance the car for 80 of the vehicles value you could borrow up to 12000.

New Mortgage

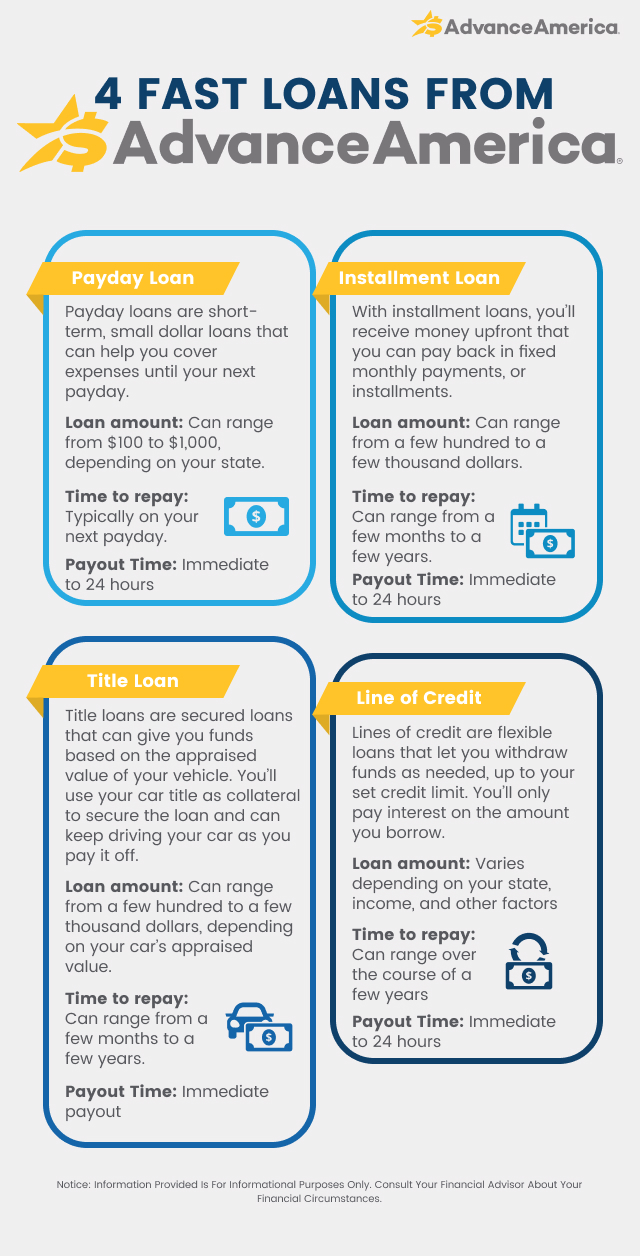

Refinance A Loan Advance America

Fixed Vs Arm Mortgage Loans Mortgage Mortgage Infographic Mortgage Loan Originator

Qt At The Bank Of Canada Assets Down 24 From Peak Spiraling Losses On Bonds To Be Paid For By Canadians Wolf Street

A Href Https Www Mortgagecalculator Org Calculators Should I Refinance Php Img Src Https Www Mo Refinance Mortgage Refinancing Mortgage Home Refinance

Should I Pay Off My Loan Early Advance America

Benefits Of Buying A Home With A Va Mortgage Loan

Apartment Loans Up To 85 Ltv Low 5 35 Year Fixed Rates

Ways To Get The Best Refinance Rates Mortgage Net Money Lessons Money Saving Strategies Saving Money Budget

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Brian Grubbs Our Staff Raleigh Mortgage Group

How To Borrow Money Fast Money Loans Advance America

Millions Of Veterans Have Already Used This Benefit See What The Va Loan Can Do For You Mortgage Loans Va Loan Refinance Mortgage

Our Staff Raleigh Mortgage Group

How Much Can You Afford For 1500 Month Mortgage Rates 30 Year Mortgage Current Mortgage Rates

2

Usda 580 Fico Up To 100 Ltv 102 Cltv Low Pmi Commercial Loans Cash Out Refinance Fha Loans